Get step-by-step support on the documents you need to successfully apply for a loan.

We understand that applying for loans can be overwhelming – especially for small business owners who already handle every aspect of a business. That’s why we’ve put together step-by-step instructions on the documents you need to successfully apply for a loan.

Identify the best loan option for you.

First, learn about funding opportunities available to small businesses in Colorado. Check out this summary of small business loan options created by The Fax Partnership.

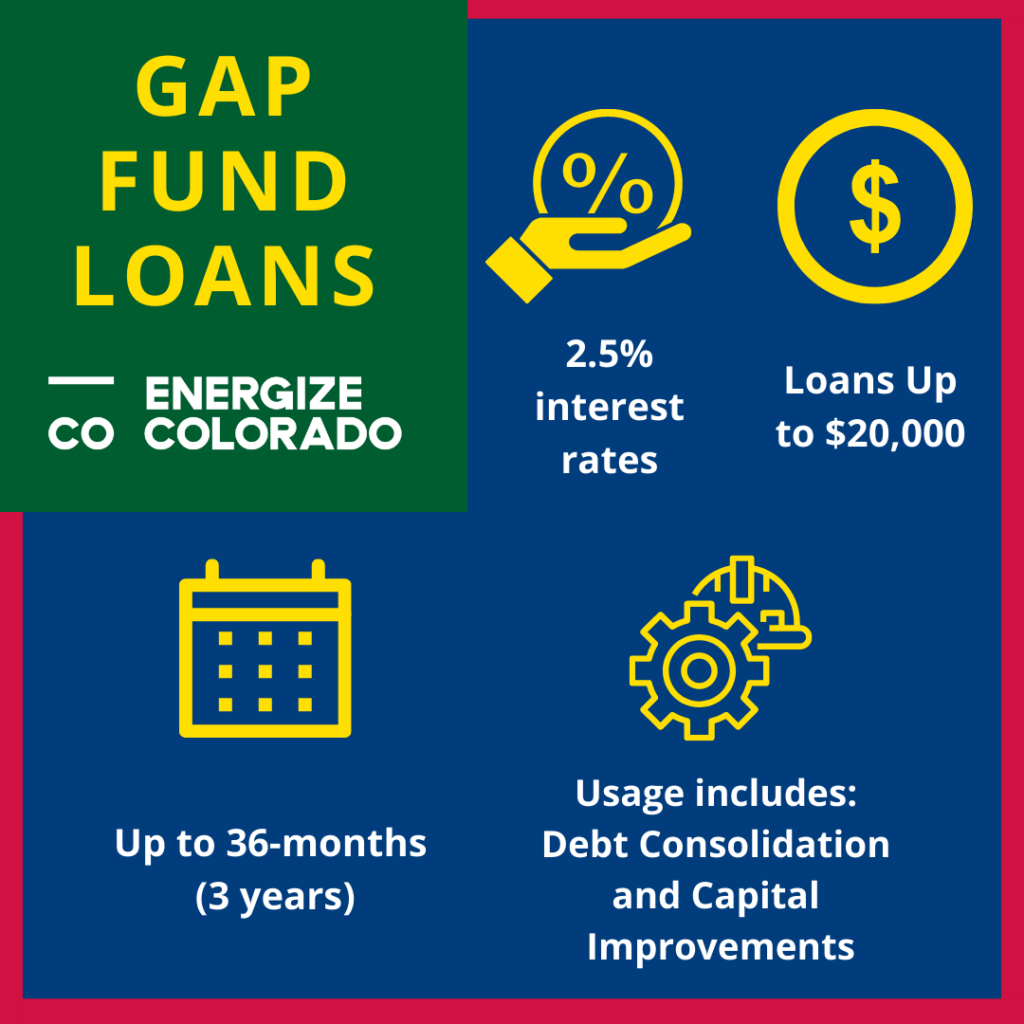

Watch the video above to learn about the ECP Gap Fund Loan — a 2.5 % loan up to $20k. Applications open in mid-May. Get on the waitlist for it here.

Are you a child care provider? Explore the best funding options for you.

Are you a child care provider looking for different funding opportunities? Watch this short video to learn about the various grants and loans that are available to home-based and center-based child care providers.

Questions? Connect with sjrampello@gmail.com – co-lead of Energize Colorado’s child care initiative.

Prepare your business plan.

In this workshop, we guide small business owners through creating a useful business plan. A business plan is required when applying for funds and provides the objectives and strategies for achieving your business goals. Areas of a business plan include a description of your business, market research and strategies (who are your competitors and how will you market your business), management/leadership, and financial documents.

Download this Business Model Canvas template to start.

Create a Profit & Loss Statement.

Next, prepare your financial documents. To apply for the loans, businesses will need:

- Profit & Loss Statement or Income Statement – A profit & loss statement shows an organization’s revenue (or sales), the cost of producing those sales (Cost of Goods), and expenses during a particular period. The P&L answers the question – What is the financial health of your business?

- Use this template to create you P&L.

Create a Balance Sheet.

A balance sheet is a financial statement of the assets, liabilities, and capital of a business at a particular period.

- An asset is something that provides a current or future value, or may provide an potential economic benefit to the business or an individual. Examples of an asset are cash, accounts receivable (owes you money), buildings, etc.

- A liability is something that would sacrifice an asset or something that your business may owe. Examples of liabilities include money owed to suppliers, mortgage debt, bank debt, credit cards, taxes, etc.

- Capital is the funds invested in the business and can be considered the equity of the business.

Create your Financial Projections.

Financial projections are the art of telling the future about your business using existing or estimated income and expense data. Financial projections provide a financial forecast of the business and is an estimate of future outcomes.

Get free support from a business advisor to best set your loan application up for success.

We have business advisors that can help! If you are requesting assistance regarding financial documents or applying for the ECP Gap Fund loans, please use this form to be connected to an Energize Colorado Business Advisor. We’ll be in touch with details as soon as possible. This form should take roughly 5 minutes or less to complete.

The Gap Fund loans will open in mid-May. If you’re not yet on the waiting list, please join the list here. We will notify you as soon as the application opens.

Here’s a checklist to help make sure you have everything needed to apply for the loan!

| Task | Who is it best for? | Complete? |

| Join Waitlist | Use this form to join the waitlist. | |

| Draft Business Plan | Reference the Business Model Canvas workshop. | |

| Draft Profit & Loss Statement | Reference the Financial Documents workshops. | |

| Draft a Balance Sheet | Reference the Financial Documents workshops. | |

| Draft Financial Projections | Reference the Financial Documents workshops. | |

| Connect with a Business Advisor | Use this form to request a business advisor. | |

| Submit Application! | More information will be available when applications open in May. |

What is the Energize Community Program?

The Energize Community Program (ECP) prepares small business owners to successfully apply for loan capital. ECP includes funding readiness workshops, low-interest Gap Fund loans up to $20k, and an accelerator program valued at $1,200. This round of Gap Fund loans is available to small businesses across 4 communities: Pueblo, Southwest Denver, East Colfax, and the Child Care Industry.

See below for information in additional languages.

en español – Click Here

中文翻譯 – Click Here

Amharic – Click Here

Vietnamese – Click Here

Burmese – Click Here