Cost of Debt Formula: How to Calculate the Cost of Debt

As a small business owner in Colorado, you know that borrowing money is both inevitable and essential. You need working capital to get your business off the ground, grow it to new heights, or sometimes just to steady your cash flow during tough times.

The loans and debt you take on come with interest rates, and if you don’t keep track of your cost of debt, those expenses can get out of control, leaving you blind to the true cost of your financing. You might even take out another loan you can’t afford.

This happens to many entrepreneurs, which is why understanding how to calculate your cost of debt is so important for making smart financial decisions.

What is the Cost of Debt?

The cost of debt is the overall cost that your company pays on borrowed money. To put it more simply, it’s how much interest your business pays on all its loans, bonds, credit lines, or any other form of debt financing.

For most loans, the cost of debt depends on the interest rate, closing costs or added fees, and repayment timeline. The higher the interest rate and fees, the higher your total cost of debt — and you want this number to be as low as possible.

Understanding this metric helps you determine if taking on debt makes financial sense for your company’s situation and future goals. It directly affects your profit margins and can reduce the free cash flow available for other business needs.

What Impacts Cost of Debt

There are several factors that influence the interest rates and fees that lenders will offer your business:

- Size and longevity of your business — Established companies generally receive more favorable interest rates than newer, smaller businesses.

- Current profitability and cash flow — Strong, consistent cash flows demonstrate your ability to make regular payments and typically result in lower rates.

- Projected future earnings — Lenders want to see that you’ll have the income to repay your debts in the future.

- Credit history — Your past behavior with debt greatly impacts your borrowing costs.

- Collateral — Assets you can offer as security may substantially lower your rate.

- Current economy — The overall economic landscape impacts interest rates, and when the economy is down, lenders often charge more to offset their increased risks.

Established businesses with strong cash flows, solid credit, and valuable collateral generally receive the most favorable interest rates. That’s why working with a lender who understands the specific challenges of small businesses is so important.

Understanding the Cost of Debt Formula

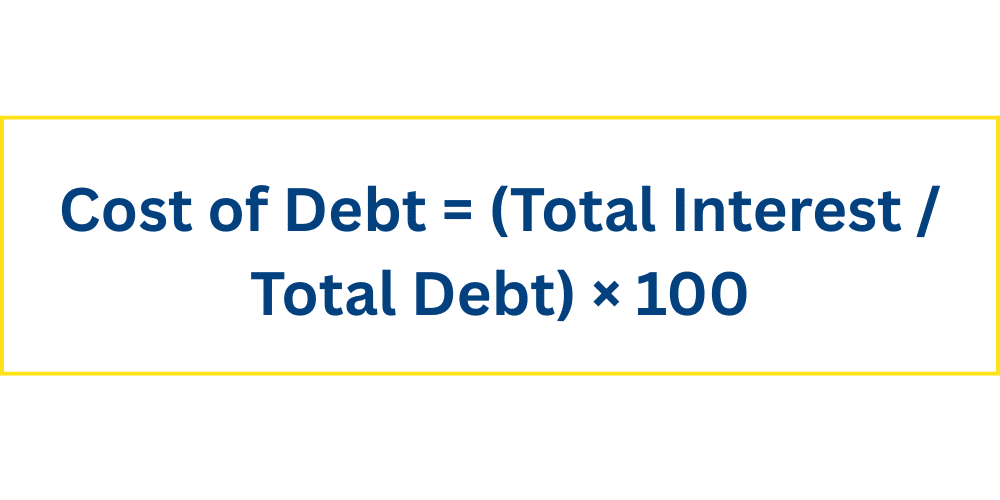

The simplest way to get your cost of debt calculation is with this basic formula:

Here is a step by step breakdown on how to find the cost of debt:

- Find your total interest by adding up all the interest expenses paid over a specific period, usually the past year.

- Determine your total debt by adding up all your loans.

- Divide the total interest by the total debt.

- Multiply by 100 to get a percentage.

For example, if your business paid $20,000 in interest last year and maintained an average debt load of $500,000, your cost of debt equation would be:

($20,000 / $500,000) × 100 = 4%

This percentage is also your weighted average interest rate, which helps you fairly compare different financing options.

Pre-Tax vs After-Tax Cost of Debt Formula

The calculation above gives you your pre-tax cost of debt. But there’s a significant advantage to business debt — interest expenses are generally tax-deductible, which lowers your true cost of borrowing.

The formula for calculating your after-tax cost of debt is:

After-Tax Cost of Debt = Pre-Tax Cost of Debt × (1 – Tax Rate)

For example, if your pre-tax cost of debt is 4% and your business’s effective tax rate is 20%, your after-tax cost would be:

4% × (1 – 0.20) = 4% × 0.80 = 3.2%

The after-tax cost is often lower, giving you a more accurate picture of what you’re really paying for financing after accounting for tax benefits.

Let’s look at another example with multiple loans. Say your small business has:

- A business term loan of $125,000 at 6% annual interest

- A business credit card balance of $7,000 at 23% annual interest

- A line of credit of $4,000 at 33% annual interest

To calculate your pre-tax cost of debt, first, find the total interest:

- $125,000 × 0.06 = $7,500

- $7,000 × 0.23 = $1,610

- $4,000 × 0.33 = $1,320

Total interest = $10,430

Next, add up your total debt:

$125,000 + $7,000 + $4,000 = $136,000

Now, calculate your cost of debt:

($10,430 / $136,000) × 100 = 7.67%

If your business has an 11% tax rate, your after-tax cost would be:

7.67% × (1 – 0.11) = 7.67% × 0.89 = 6.83%

Every business has different financing needs and tax situations, so your calculations will vary. The key is understanding the true cost of your company’s debt so you can make informed decisions.

Get Help With Your Business Funding from Energize Colorado

At Energize Colorado, we understand that every dollar counts toward your business’s success or failure, which is exactly why we’re committed to providing low-interest loans and personalized support to entrepreneurs across our state.

Our cash flow loans are specifically designed to help you manage your business’s day-to-day operations while maintaining healthy finances and keeping your cost of debt manageable.

We offer financing up to $150,000 with repayment terms up to 5 years, and unlike traditional banks, we look beyond just credit scores to understand your business, and we consider factors like your unique market position, growth potential, and community impact.

At Energize Colorado, we offer expert guidance and resources to support your success every step of the way.

If you’re ready to take the next step in growing your business, begin the application process today. Our team is ready to help you calculate your true cost of debt and find financing that works for your unique situation.

Remember, understanding your cost of debt isn’t just about number-crunching — it’s about making strategic financial decisions that will help your business thrive, not just now, but in the future too.