On April 29th, 2022, Energize Colorado convened a group of leaders from Colorado’s small business ecosystem. Including nonprofit lenders, technical assistance providers, philanthropic organizations, and state leadership, this group represented the diversity of Colorado’s small business ecosystem.

Kicking off with Colorado Office of Economic Development and International Trade Office Executive Director Pat Meyers, the discussion centered around deploying capital and technical assistance to Colorado’s small businesses. As a group, we explored these questions: “What does the current state of capital deployment look like in the state, and what steps can we take to improve on the gaps we’ve found and seen amplified throughout the COVID-19 pandemic?”

Gathered together for one of the first few times in person, it was an incredible opportunity to dig deep on an issue we’ve all seen the effects of recently. All of our shared perspectives are meaningful and needed in order for us to address any topic. We’re proud that this group came together on this one, and we look forward to a continued series of dedicated planning sessions like this.

Through a series of facilitated conversations, this complex challenge of capital absorption was broken into three more manageable concepts.

- Retrospective on the History of Capital in Colorado

- Rethinking the Possible

- The Path Forward

Before digging into the themes we sourced from this meeting, it’s important to define what capital absorption (CA) means.

CA is the ability of capital to effectively meet the pressing needs of a community. In the last two years, this has been represented as our entire state’s ability to deploy loans and grants to small businesses in order to stave off the effects of the pandemic, associated lockdowns, and funding workforce expansion. Additionally, there are three components to CA:

- Attracting Capital: raising private and public funds to deploy

- Access to Capital: making capital available to those that need it

- Capital Deployment: mechanisms and strategies for deploying funds to businesses (this includes CDFIs & Technical Assistance)

Retrospective on the History of Capital in Colorado

Using small discussion groups, we aggregated themes of past attempts to improve capital access and deployment in the state. The largest learning from this segment was the tension between a broad desire/need to systemize more of the access systems across the state while balancing the requirement that diverse businesses need a tailored approach. We see this played out in the following two examples; a statewide network of Small Business Development Centers (SBDCs) and local technical assistance providers focused on serving micro-communities. The same findings are seen by the balance the state has in funding both regional loan funds and the large/statewide CDFIs. Throughout COVID, we have seen this further amplified by the need to balance digital and in-person support, access, and connection.

Access to capital remains a top concern for both lenders and businesses alike. Currently, there is a dual-sided pipeline for loan referrals and origination, primarily from big banks to local lenders and secondly for local lenders helping their businesses “graduate” up to larger, national banks. We’ve seen attempts to improve this system but many of these referrals stem from the relationships built between individual loan officers and underwriters.

In addition, there is the rapidly rising network of predatory lenders across the nation, promising fast cash but at a cost too high and often unseen by small business owners themselves.

Rethink the Possible

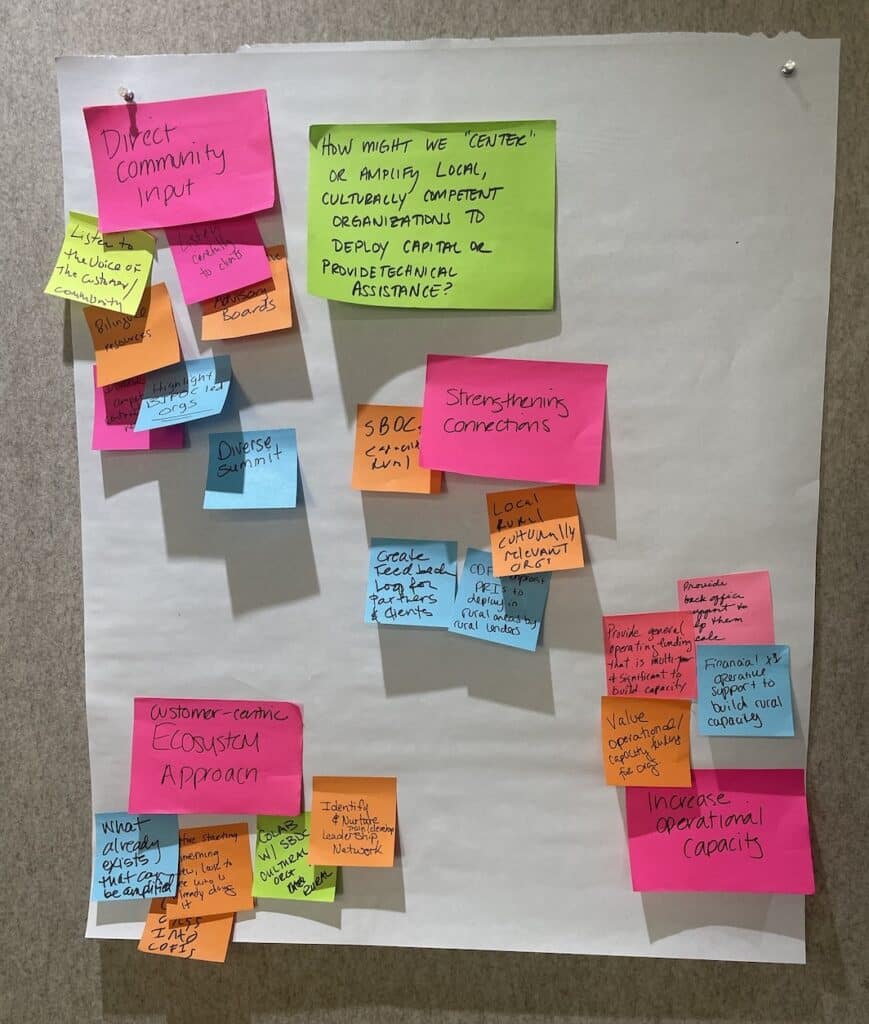

Taking the themes from the retrospective discussion, the group drafted eight “How Might We…” questions meant to inspire ideas around potential solutions, strategies, and next steps.

How might we:

- Address a shared problem together?

- Promote efficient and strategic collaboration?

- Connect TA and funding for small businesses in a way that is easy/strategic/efficient?

- Be more user-centric in deploying capital to small businesses?

- Amplify the local/culturally competent organizations that provide Technical Assistance/Funding?

- Build trust with communities that have been historically under-invested in?

- “Ready” organizations to adopt and implement new technologies?

- Leverage new tech to deploy capital more efficiently?

Themes Identified from the “How Might We” Questions:

- Strengthening Connections Between Funding/Technical Assistance Network

- Collecting Community Input on Capital Deployment

- Creative New Capital Options

- Technical Assistance/Lender Training & Financial Support on new Technologies

- Common Funding Applications

- Policy Changes & New Condition Setting

From these six shared priorities, attendees were asked to rank these in the order they felt they should be addressed and to let us know why.

The Pathway Forward

Energize Colorado is eager to take these themes and move forward into a series of further, facilitated conversations with industry partners. For the next six months, we will continue to gather this group on a bi-monthly basis to tackle three modified versions of the items listed above:

- June: Strengthening Connections Between Funding/Technical Assistance Network & Investigating Trainings for New Tech

- August: Collecting Community Input on Capital Products

- October: New Capital Products & Common Funding Applications

By November, Energize Colorado will compile all findings into a report and share them with Colorado state leadership, including Governor Jared Polis,

If you’re interested in joining these conversations, or you have thoughts you’d like to share please reach out to me at scott.romano@energizecolorado.com.