At Energize Colorado, we know that our goal to build a diverse and resilient small business ecosystem can not be achieved alone. We rely on like-minded partners and industry leaders to propel the small business ecosystem in Colorado forward.

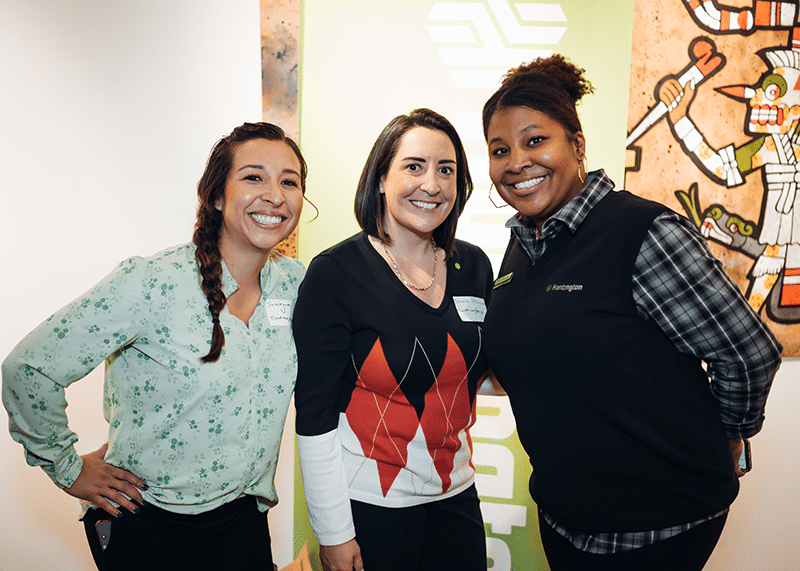

Huntington Bank believes in empowering small businesses and investing in the small business community. In November, Huntington Bank sponsored our Energize Community Program Celebration, which celebrated small business owners from across the State who received our Gap Fund loans and completed our Community Accelerator program. Huntington Bank’s team – Nicole Marquez–VP, Community Development Relationship Manager, Serena Valdivia – Branch Manager, and Mesha Galligan–Executive Assistant to the Regional President – all were present to share the resources Huntington Bank offers to help small businesses grow in scale. It is our intention to connect the small businesses we serve with mission-aligned banks to gain access to good capital that will help them take their business to the next level. Additionally, Huntington Bank has invested in Energize Colorado to support our Energize Community Program in the Southwest Denver and East Colfax communities.

“Energize Colorado’s focus on serving small business owners aligns strongly with Huntington’s Community Plan,” said Marquez, “and locally, we have been able to collaborate on more than one occasion.”

Huntington Bank offers a loan program specifically for businesses owned by minority-,women-, and veteran-entrepreneurs, as well as businesses located in low- or moderate-income census tracts. Lift Local was designed to support small businesses throughout the business life cycle — from start-up to expansion. The program offers loans, business planning support, and other services to help business owners achieve their goals. This program is looking out for you, so you can look out for what’s best for your business, your family, and your customers.

Lift Local Business Loan Features

- Loan amounts from $1,000 – $150,000

- Access to capital at a low cost to your business

- Zero origination fees

- Huntington pays your SBA fees

- Lower credit score requirements

- Free financial education courses ($1,500 value)

- No monthly service fee checking account† with

- 24–Hour Grace Overdraft and Return Fee Relief

- Longer repayment terms to help avoid high payments

Huntington Bank is the Number 1 SBA lender in the nation in the number of 7(a) Loans. If you are looking to apply for the Lift Loan visit any Huntington Branch or call (800) 480-2001.