Energize Community Program FAQ and Support

The ECP Gap Fund FAQ is a resource to answer your questions about the Energize Community Program Gap Fund Loan. If you can’t find what you’re looking for, please contact us at [email protected]

What is the Energize Community Program?

The Energize Community Program (ECP) prepares small business owners to successfully apply for loan capital. ECP includes funding readiness workshops, low-interest Gap Fund loans up to $75,000, and no-cost educational programming. This program is open statewide in Colorado.

How does this work?

In 2020, we raised capital to deploy from private donors to distribute through low-interest loans. We also are a partner with the state’s CLIMBER program.

Distribution of funds will follow guidelines and allocations established by our Board of Directors. Our Board of Directors is a diverse group of members experienced in lending and community development, as well as leaders representing the communities we aim to serve.

Funds will be distributed statewide. The goal is to address the critical needs of micro and small businesses within under-invested in communities.

Our Finance Committee will monitor how these loans are used and address special needs.

What is the cutoff date for applications?

There is no cutoff date.

If you sign up for our newsletter here, you will be notified with any updates.

If I have previously received financial support from Energize Colorado, am I eligible to apply?

You are eligible to receive a total of $75,000 in loans from Energize Colorado.

If you received $20,000 previously, you will be eligible to receive another $55,000 but it will be an additional loan.

Can I use my phone to apply?

Yes, the application process is mobile-enabled. Documents can be photographed and attached to the application.

Is the ECP Gap Fund first come first serve?

No, we will not assign loans in the order applications come in. Applications will be reviewed together in phases to ensure they meet all program requirements and eligibility. We would prefer an applicant to spend adequate time on their application rather than rush. We advise that applicants connect with a business advisor to ensure all financial documents are in order prior to submitting their application.

I started my business during COVID, am I eligible?

Yes. If you have been in business for more than 3 months you are eligible to apply.

If approved, when will the funds be available?

It is our desire to move the funds as quickly as possible once the application is approved.

How does the distribution of funds work?

Distribution of funds will follow guidelines and allocations established by the Board of Directors. Our Board of Directors is a diverse group of members experienced in lending and community development, as well as leaders representing the communities we aim to serve.

ELIGIBILITY

Who is eligible to apply?

Small businesses/enterprises – Registered small businesses in good standing with the state.

New and existing businesses are eligible. At least three months in business.

Small businesses must have fewer than 50 employees. An employer may use its off-season employee count.

If you apply as a sole proprietor, we will ask you to switch to an LLC structure before receiving funds.

The Cannabis Industry is not eligible but what about the Hemp Industry?

Businesses that grow, distribute, or sell Cannabis are not eligible per federal requirements of this program. Hemp businesses will be allowed as long as they meet federal and state guidelines.

Please see the following document for further clarification: https://www.sba.gov/sites/default/files/2019-02/SOP%2050%2010%205%28K%29%20FINAL%202.15.19%20SECURED%20copy%20paste.pdf

Are farmers/farms eligible?

Yes.

I don’t have a way to scan or upload documents? What do I do?

Required documents can be photographed and attached to your application.

If you believe you will need additional assistance, you can connect with a business advisor here, and we will assign an advisor who can work with you to fill out the application with you.

Will it count against me if I apply for the Gap Fund again?

No. If you have received a loan previously, that will be taken into consideration.

What if I can’t find my EIN/TIN?

If you previously applied for and received an Employer Identification Number (EIN) for your business, but have since misplaced it, try any or all of the following actions to locate the number:

Find the computer-generated notice that was issued by the IRS when you applied for your EIN. This notice is issued as a confirmation of your application for, and receipt of an EIN.

If you used your EIN to open a bank account or apply for any type of state or local license, you should contact the bank or agency to secure your EIN.

Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced EIN. Your previously filed return should be notated with your EIN.

Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. The hours of operation are 7:00 a.m. – 7:00 p.m. local time, Monday through Friday. An assistant will ask you for identifying information and provide the number to you over the telephone, as long as you are a person who is authorized to receive it. Examples of an authorized person include, but are not limited to, a sole proprietor, a partner in a partnership, a corporate officer, a trustee of a trust, or an executor of an estate.

Can I apply if I am an immigrant? What documentation do I need to provide?

An individual (i.e. a sole proprietor of a business) will need to provide one of the following:

- Valid Colorado driver’s license or a Colorado identification card issued by the Colorado Department of Revenue.

- Valid US passport

- US Military Identification card OR Military Dependent’s Military ID card

- United States Coast Guard Merchant Mariner card

- Native American Tribal Identification Document

- Valid Foreign Passport with Photo AND valid US Visa AND I‐94

- Certificate of Citizenship with photo (less than 20 years old)

- Valid Employee Authorization Document/Temporary Resident

- Refugee/Asylee I‐94 with photo

- Valid I‐551 permanent resident card

Are only Colorado small businesses eligible?

Yes, only domestic entities formed under Colorado law are eligible. A Colorado domestic entity is a business registered, and in good standing, with the Colorado Secretary of State. Foreign entities that have filed with the Colorado Secretary of State to conduct business in Colorado are not eligible, for example, a business formed under Delaware law is not eligible.

Are cooperatives eligible to apply?

Yes. Any domestic entity type that is a nonprofit corporation is eligible.

FINANCIAL

Is this a grant or a loan program?

This is a loan program.

What is the difference between a grant and a loan?

Grant money provided to an eligible small business is not required to be repaid. A loan has an assigned interest rate and must be repaid over a defined period of time.

If I apply, am I guaranteed a grant or a loan?

No, the Gap Fund is not a first-come, first-serve program. It is a competitive program. Each application will be thoroughly evaluated and approved if applicants meet the criteria. While we hope to help as many people as possible, these funds will eventually run out and all applicants are not guaranteed a loan.

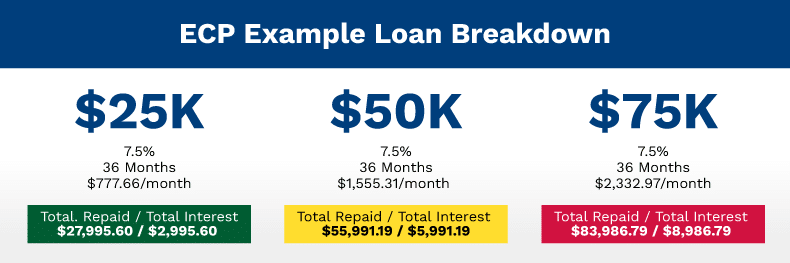

What will the loan payments be like?

For loans equal to or lesser than $75,000, your payment term is 36 months. The interest rate is a flat 2.9-8.5% during the duration of the loan.

What are the terms of the loan? Anticipated loan terms?

- Principal amount: up to $75,000

- The maturity rate is 36 months for loans up to or equal to $75,000.

- The interest rate is: 3.6%-8.5% throughout the duration of the term.

Are there limits on what I can spend my loan on?

Yes, loans may be spent on items agreed to in your application and closing documents.

Examples of allowable expenses include:

- Debt consolidation

- Payroll costs

- Increased workers compensation cost due to COVID-19 pandemic

- Premium Pay

- Hazardous duty, physical hardship in case related to COVID-19 pandemic

- Overtime related to COVID-19 pandemic

- Employee stipend if deemed necessary due to COVID-19 emergency provided on a reimbursement basis

- Capital Improvements

- Rent/Lease

- Utilities

- Working Capital

- Equipment

- Inventory

How will I receive the funds if awarded?

ACH or Paper Check, depending on your choice.

If I receive a loan, are there any prepayment penalties?

No, there are no prepayment penalties with Gap Fund loans.

Will these loans be collateralized?

Loans made through the CLIMBER loan fund must all include collateral. For Energize general loans $50,000 or above will be required to offer collateral through a UCC lien. This will add one step to your closing process and you will be walked through it by our Loan Officer.

Will Energize Colorado pull my credit? Are there credit requirements?

Yes, we will pull an applicant’s credit, however, there is no minimum credit score.

What is the maximum amount I can request from the Gap Fund?

You can request a maximum of $75,000 from the ECP Gap Fund.

Are Gap Fund loans considered taxable income?

Gap Fund loans are not considered taxable income.

OTHER FAQ’S

What to do if a company is new and has not yet invoiced anybody?

Businesses must be generating revenue for at least 3 months.

Is credit score a determinant of getting the funds?

No, a credit score is not a determining factor.

Do you know if I can apply for the funds with an ITIN number?

Yes, you can.

If the company has more than one owner, will you review the credit score of all the owners? Should all the owners sign the application?

We recommend primary owners sign the application.

What are the loan minimum and maximum?

The minimum amount available is $1K. And the maximum amount available is $75K.

Is there a payment or a fee if the loan is paid in advance?

There is no fee.

Do I have to pay fees if I cannot make a payment?

Yes, we have late fees.

How long does it take to get a loan approved?

At this time, we’re looking at about 3 weeks for an approval.

Are there any fees or costs when one closes the loan?

Depending on the program (determined by our loan officer), there may be a small origination fee.

Do you ask for collateral?

Yes, for amounts above $50K.

Do you sell the loan to other financial institutions?

No, our loans are serviced by Energize Colorado.

Should I declare the loan as an income?

No, the loan will fall on your balance sheet as a liability.

Office of Economic Development and International Trade, we thank you!

Sate Economic Development Commission, we thank you!

Colorado Housing and Finance Authority, we thank you!

Colorado Lending Source, we thank you!

State of Colorado, we thank you!

Colorado General Assembly, we thank you!

Governor Polis, we thank you!

Gap Fund Executive Committee chaired by Kent Thiry, we thank you!