Business Debt Consolidation Loans in Colorado

Assisting with debt relief in Colorado.

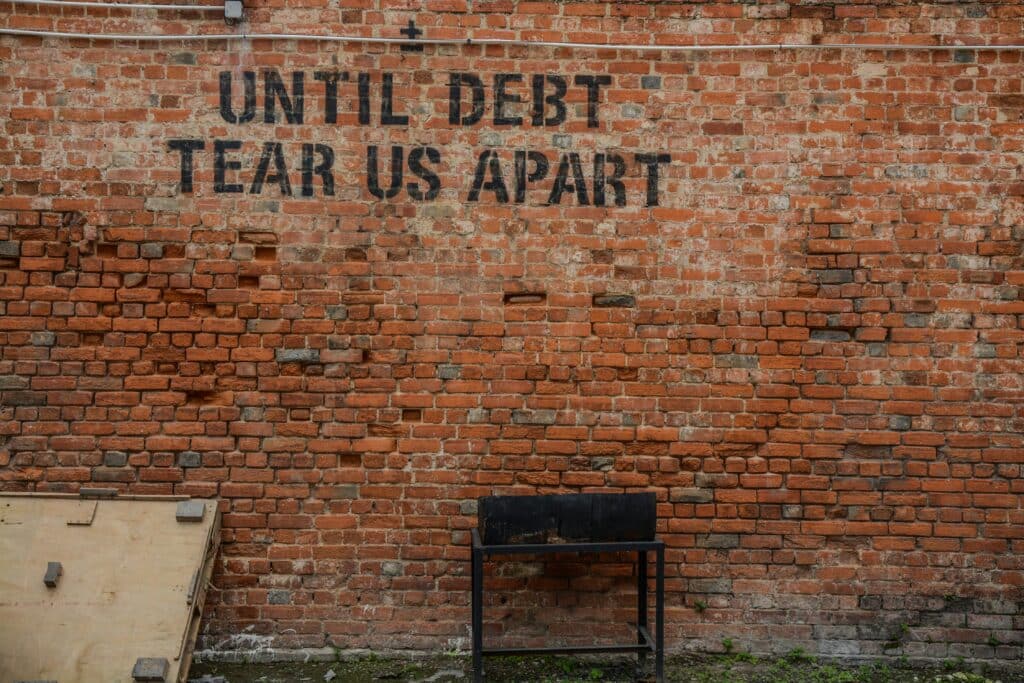

Managing multiple debts can feel like you’re stuck in a financial maze—bills coming from all directions, due dates scattered across the month, and interest piling up faster than you can keep track. If this sounds familiar, a debt consolidation loan in Colorado might be the reset you need. This approach lets you roll several debts into one manageable monthly payment, often at a lower interest rate. The result? Simpler budgeting, less stress, and a clearer path to financial freedom. Let’s break down how consolidating debt works, the types of debt you can include, and how to consolidate debt and get started in Colorado.

What is debt consolidation?

Debt consolidation means taking out a single new loan to pay off several existing debts. Instead of juggling credit cards, payroll, and past due invoices, each with its own terms and rates—you’ll make one payment each month. The benefit here isn’t just simplicity. In many cases, the loan you use to consolidate debt comes with a more competitive interest rate than what you were paying before. That means you can save money over time and possibly pay off what you owe faster. With fixed monthly payments, you’re better able to plan your budget and track progress toward becoming debt-free.

Types of Debt to Use a Debt Consolidation Loan For

A business debt consolidation loan can cover a range of unsecured business debts. But not everything qualifies. While you can use it for common operational debt, you can’t use this funding for secured loans like equipment financing, real estate mortgages, or any debt tied to specific collateral.

Let’s look at the business debt types that are eligible.

Business Credit Card Debt

Business credit cards often carry some of the highest interest rates in commercial lending. If you’re only making minimum payments to keep operations running, you could be stuck in a cycle where the balance barely budges, and a business debt consolidation loan can help you break free.

Consolidating high-interest business credit card debt into a loan with a lower rate means more of your monthly payment goes toward the principal—not just interest. That can add up to significant savings and help your business eliminate debt faster while improving cash flow.

Payroll Tax Debt

Falling behind on payroll taxes can quickly spiral into a serious problem for any business. The IRS and state agencies charge steep penalties and interest on unpaid payroll taxes, and they have powerful collection tools at their disposal.

By consolidating payroll tax debt into a structured repayment plan, you can avoid aggressive collection actions while making steady progress toward compliance. A predictable monthly payment also helps you budget more effectively and prevents future tax issues.

DISCLAIMER: Borrowers are not permitted to use Energize Colorado funding for payment of back taxes.

Outstanding Vendor Invoices

Unpaid vendor invoices can damage crucial supplier relationships and disrupt your supply chain. When you’re juggling multiple overdue accounts, vendors may put you on credit hold or demand cash on delivery, straining your working capital even further.

Consolidating vendor debt allows you to pay off suppliers immediately, potentially negotiating discounts for prompt payment. You’ll restore vendor relationships while converting multiple unpaid invoices into a single, manageable monthly payment.

Merchant Cash Advances

If your business has taken multiple merchant cash advances (MCAs), you know how quickly daily or weekly payments can drain your cash flow. MCAs often come with extremely high effective interest rates, and stacking multiple advances can cripple your business’s finances.

Consolidating MCAs into a traditional loan with fixed monthly payments can dramatically reduce your payment frequency and total cost of capital. This gives your business breathing room to focus on growth instead of just surviving the next automatic debit.

Short-Term Business Loans

Multiple short-term loans with different rates, terms, and payment schedules can be overwhelming to manage. If your business’s financial position has improved since you first borrowed, consolidating into a new loan could mean better terms and a lower rate.

You’ll want to ensure that the new rate and terms actually improve your cash flow, but if they do, consolidation can help you pay off those loans more efficiently while simplifying your financial management.

How to Get a Debt Consolidation Loan in Colorado

Applying for a consolidation loan doesn’t have to be complicated. Whether you’re a small business owner, a contractor, or a freelancer, the key is understanding your financial picture and choosing a lending partner who looks at more than just credit scores.

Energize Colorado makes this process straightforward and human-focused. Our lending team takes into account your goals, not just your past financial history.

Our Simple Process

- Express interest by completing our quick online interest form

- Get matched with a lending specialist to complete your loan application

- Receive your funds in less than 30 days if accepted

*we review each application on a case-by-case basis

Loan Terms that Work for You

We offer consolidation loans with terms that fit your budget:

- Loans from $5,000 to $150,000

- Competitive interest rates

- 3-5 year repayment terms

- Simple, transparent fee structure

- No prepayment penalties

DISCLAIMER: Borrowers are not permitted to use Energize Colorado funding for payment of back taxes. Borrowers can only use up to 50% of our funding for debt consolidation.

Let Us Help You Consolidate Your Debt

If you’re tired of feeling like you’re barely staying ahead of the bills—or watching your interest stack up faster than you can pay it down—debt consolidation services might be the right next step.

We’ve helped Coloradans from all walks of life get back in control of their finances. Whether you’re managing credit card balances, invoices, or cash advances; we’re here to guide you with honest advice and practical funding options.

Getting a debt consolidation loan in Colorado isn’t just about saving money—it’s about peace of mind. It’s about simplifying your financial life so you can focus on what matters most.

If you’re ready to consolidate debt and take control of your future, start by submitting our interest form today. We’ll walk you through the process and make sure you’re matched with a loan that fits your needs.

You don’t have to manage debt alone. Let’s work together to simplify your payments, reduce your interest, and put you on the path to financial confidence.

Your Journey to Growth Starts Here!

We’re thrilled you’re considering taking your business to new heights with our low-interest loan.

Click the “Get Started” button to take the first step of your application process by submitting our interest form!

Energize Colorado made securing capital easy and encouraging unlike traditional lenders.

John, Låda Cube