We’re here to help grow your business

Energize Colorado provides lending, resources and advising to small businesses across the state. Whether you own a local coffee shop or specialize in child care, we’re here to help strengthen your business.

What sets us apart

Quick Approval

Our straightforward application process is fast and uncomplicated

Low Rates

Affordable capital at a reasonable rate between 3.6% – 8.5%

Resources

Access our business directory for answers to various questions

Mentorship

Grow your business with free one-to-one mentorship by a trained advisor

Who we serve

We are builders and innovators focused on serving Colorado’s smallest businesses including BIPOC, women, veteran, and rural-owned businesses in underserved areas.

Our Process

Submit an application for up to $75k

Approval determined within 14 days

Engage in mentorship with a business advisor

Tailored programming to accelerate your business

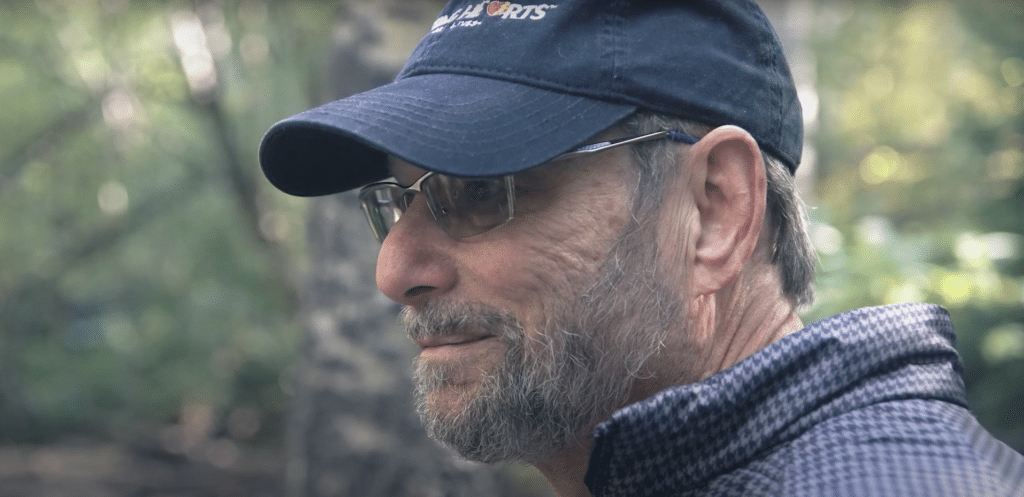

“I recently qualified for a low-interest loan, which I’ve used to pay off higher-interest business debt—a huge relief. This will allow me to more easily pay off the cost of the business development that it was used for.”

Amy Hayes

Founder of Amy Hayes Designs

Energize Community Program Loan Recipient

Get to know us

Press, news, important updates and information from all of us at Energize Colorado

Starting Hearts and the Energize Community Program

We teach lifesaving skills to thousands of students and adults each year to effectively respond to sudden cardiac arrests and save precious lives.

Small Business Success Story: Copper Door Coffee Roasters

This small business’s journey underscores the importance of hard work, perseverance, innovation, and a steadfast commitment to quality.

Energize Colorado – Colorado’s Newest Mission Based Lender

Over the last three years, Energize has deployed a total of $45 million in grant and loan capital to more than 5,000 business owners and entrepreneurs.